Diabetes is a condition that affects more than 29 million people in the United States or upwards of 10% of the American population. While the number of those with diabetes is on rise, the medical industry continues to bring out fresh medicines such as the new insulin product Toujeo and an empagliflozin/metfomin combination called Synjardy.

While these new medications are improving the quality of life for those with diabetes, they are not low-cost! According to research, an American with diabetes can expect to spend twice as much on medical expenses as someone without the disease, or approximately $8,000 a year. In addition to paying for test strips, diabetes medication, and doctor visits, diabetes costs can include money lost due to sick days from work, low work productivity, and unemployment.

How can someone who is suffering from diabetes get the best that life has to offer without ending up in the poor house? We’ve composed a “cheat sheet” of twelve tips to help people continue to receive quality care and the necessary diabetes medications at the lowest cost possible.

1. Alternative Diabetes Medications

Talk to your doctor about using generic medication. Metformin (Glucophage) and Metformin XR (Glucophage XR) are most likely what your doctor will prescribe when you ask for generic prescriptions. When combined with insurance, you can often receive these generic brands for as little as $5 per month. If your insurance has a high co-pay, consider looking online at GoodRx.com to find a cheaper price if you pay with cash.

2. Look Into Online Pharmacies & Comparisons

While there are a lot of scary online pharmacies out there, there are also a lot of really good, legitimate sources of diabetes medicine available over the internet from safe and licensed Canadian pharmacies that can save you a ton of money. You can discover who is legal and who isn’t by finding reputable pharmacies on eDrugSearch.com.

Click here for our comprehensive list of diabetes medications and drug prices.

3. Compare Prices on Long-Lasting Insulins

Some people choose to use newer insulins; while these can raise ones diabetes medicine cost over other prescriptions, they provide more low-blood sugar protection. These long-lasting insulins include Levemir vial, which usually lasts around 15 hours, and Lantus vials, which lasts about 24 hours. When you use a long-lasting insulin, carefully compare the prices and take into consideration that Levemir may need to be used twice a day, whereas Lantus only needs to be dosed once. Also, check with your insurance company to see which long-lasting insulin they prefer. These diabetes medications also are included in savings programs that can reduce costs down to as low as $25 per pen.

4. Make Comparisons on Newer Injectables

If you take injectables such as Victoza (liraglutide) and Trulicity (dulalutide), you can rest assured that your diabete costs are going to be pretty high. Since these medications are especially good for lowering A1c and weight loss, it maybe impossible to switch to a generic; however, you can still carefully consider which of the two medications is the least expensive and shop for prices online. Byetta (exenatide) may seem more cost efficient, but has to be used twice daily. When comparing prices, take into consideration that Victoza is used once daily, whereas Bydureon Pen (exenatide) and Trulicity are only used once a week.

5. Look Into DPP-4 Inhibitors

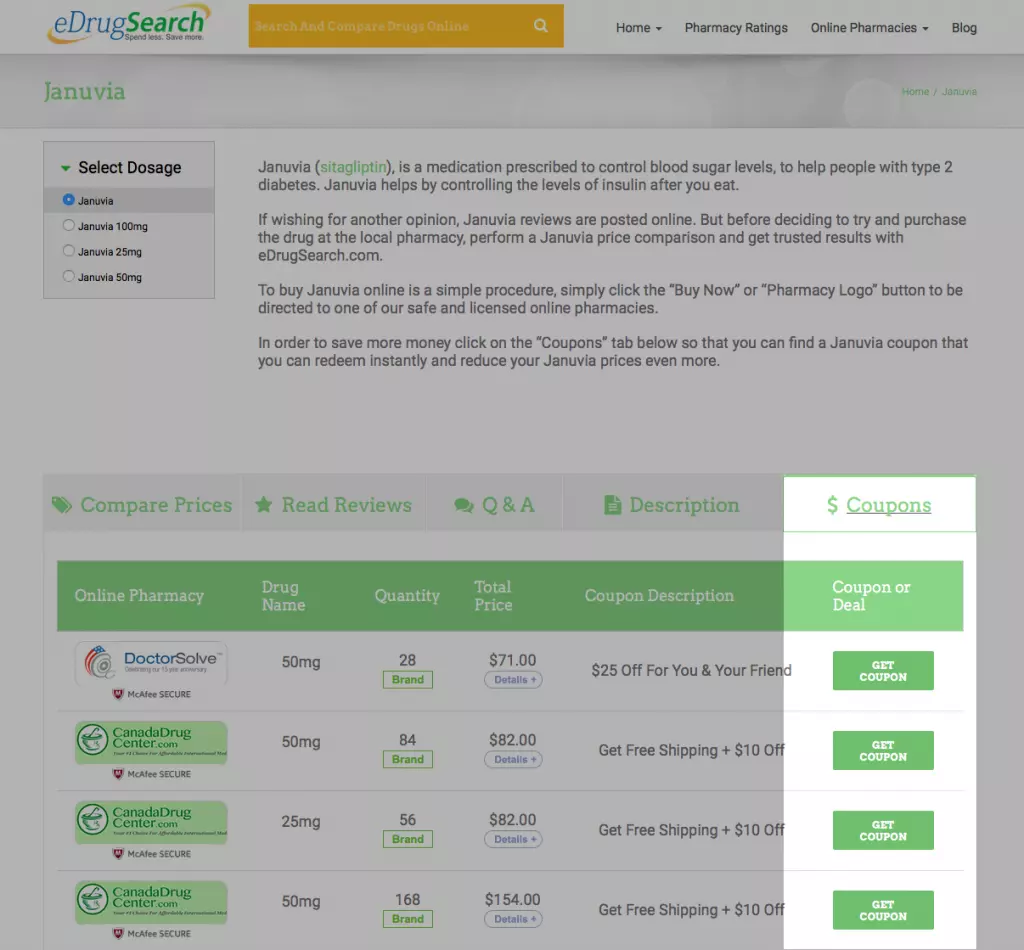

While these DPP-4 inhibitors such as Januvia (sitagliptin) and Onglyza (saxagliptin) seem more expensive, they work better than the cheaper options glyburide micro and glipizide xl and maybe something you need to consider. Onglyza 2.5mg and Onglyza 5mg tablets cost the same amount, making it possible to split them if necessary. Likewise, Januvia 50mg and Januvia 100mg tablets sell for the same price. If you use both Januvia and metformin, you can lower the cost of diabetes medicine by getting Janumet and Janumet XR which is a combination of the two at the same price as Januvia alone.

6. Check to See How Insurance Will Help

Depending on your insurance, glucometers and test strips can be covered, leaving you to pay nothing or a fraction of these diabetes costs. Insurance companies Aetna and Anthem use an in-network pharmacy to cover 100 strips a month. Before making any purchases, see what your insurance will cover and only buy those brands to lower your diabetes costs.

7. Find Samples & Freebies

If you don’t have insurance that will cover your glucometer or test strips (Example: Accu-Chek Test Strips), you still have options. You can lower your diabetes medicine cost by checking prices for test strips on the internet, and look for free glucometer offers.

You can get diabetes medicine for no cost at all by asking your doctor for samples; also, look for Diabetes Expos where there are frequently free health screenings, classes, and free samples, or contact the supply companies directly.

8. Help with Rx Coupons & Sales

To keep lowering your diabetes medicine cost, keep your eyes open for sales and coupons. Don’t be afraid to shop around for your prescriptions, switching from one pharmacy to the next as you hunt down the best prices. You can easily find local rx coupons at your neighborhood pharmacy by using the GoodRx.com. However, it you want to save the most we recommend using eDrugSearch.com for finding the best rx coupons. All you do is type in your drug name, click on your drug name and click on the “Coupons” tab, then click “Get Coupon” to copy and instantly redeem your rx coupon as shown below.

9. Look for Patient Assistance Programs

If your insurance doesn’t cover your diabetes medication costs, you’re not totally out of luck; thanks to these helpful patient assistance programs such as the Partnership for Prescription Assistance and Together Rx Access, you can still receive discounts. These programs are often sponsored by drug manufacturers and help people to get their diabetes medication and supplies at an affordable price.

10. Contact Non-Profit & Special Interest Groups

Some groups such as Kiwanis International Clubs help support a variety of children’s health programs and the Lions Club International sponsor several programs that help prevent blindness and screen for vision problems and are specifically supportive of diabetes prevention and control measures.

11. Opt for Home-Cooked Meals

You can not only improve your health but also lower your bills by finding diabetic recipes online and cooking meals at home that consist of whole and fresh foods. While companies may try to convince you that specialty “diabetic” products are best for you, these meals are highly processed and expensive.

12. Care for Your Whole Body

Diabetes is not just a challenge to keep blood sugar under control; instead, it is a disease that can affect your entire body. To lower the cost of health care, take a holistic medicine approach by taking care of your whole self. Cessation of smoking, avoiding alcohol, eating healthy, and exercising can greatly lower your trips to the doctor.

Sometimes, having diabetes can feel like it’s a sentence to always have high medical bills and expensive prescriptions; however, this doesn’t have to be the case. By implementing the twelve money saving tips listed above or joining a Diabetes Support Group you can get the most out of your money while still receiving the best medication and care. Use these tips to help you lower your costs and relieve your mind, so you can start focusing on what matters: Enjoying your life and getting the most out of it.

eDrugSearch.com’s “99 Ways to Save Money on Your Prescription Drugs”

eDrugSearch.com’s “99 Ways to Save Money on Your Prescription Drugs”

Reflecting on the history of Canadian drug reimportation legislation

Reflecting on the history of Canadian drug reimportation legislation

![[Video] Pharma “Bad Boy” Martin Shkreli Refused to Testify to Congress](/wp-content/uploads/2016/02/Pharma-22Bad-Boy22-Martin-Martin-Shkreli-500x383.png)

Leave a Reply

Be the First to Comment!