When you walk into a pharmacy and pick up a generic version of your prescription, you’re probably thinking about saving money. But behind that simple transaction lies a complex economic battle-one that can make the difference between a drug being affordable or unattainable. The number of generic competitors entering the market doesn’t always mean lower prices. In fact, sometimes, the more competitors there are, the less prices drop-and sometimes, they even go up.

More Competitors Don’t Always Mean Lower Prices

The idea is simple: more generic drug makers = more competition = lower prices. And that’s often true-at first. When the first generic version of a brand-name drug hits the market, prices typically drop by 30% to 40%. With two generics, that jump to 54%. By the time six or more companies are selling the same drug, the average price can fall by 95% compared to the original brand.

But real life doesn’t follow the textbook. In Portugal, for example, statins-common cholesterol drugs-have multiple generic manufacturers, yet prices stay stubbornly high, often right at the government’s price cap. Why? Because companies aren’t competing against each other as much as they’re quietly coordinating. When the same few firms face each other across multiple drug markets, they learn not to undercut one another. This is called mutual forbearance. It’s not collusion. It’s just smart business in a system that rewards stability over competition.

The Paradox of the Originator

It’s not just generics playing the game. The original drug makers-the brands-are still in the ring. In China, a 2023 study found that 15 out of 27 brand-name drugs kept over 70% of the market even eight quarters after generics arrived. That’s more than two years. And here’s the twist: some brands actually raised their prices after generics entered the market.

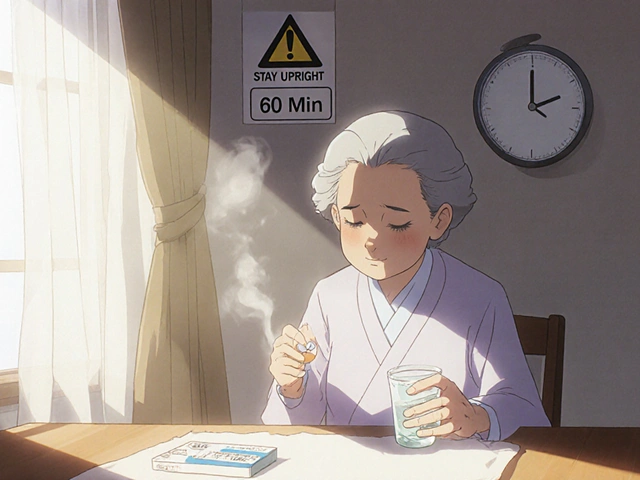

Why? Because patients and doctors still trust the brand. If a drug is for a serious condition like epilepsy or heart failure, people don’t want to switch. Doctors are cautious. Pharmacies stick with what’s familiar. So instead of slashing prices to fight for market share, some brands double down on perception-marketing their drug as safer, more reliable, or better tolerated. They raise prices slightly, betting that loyal customers will pay more to avoid risk.

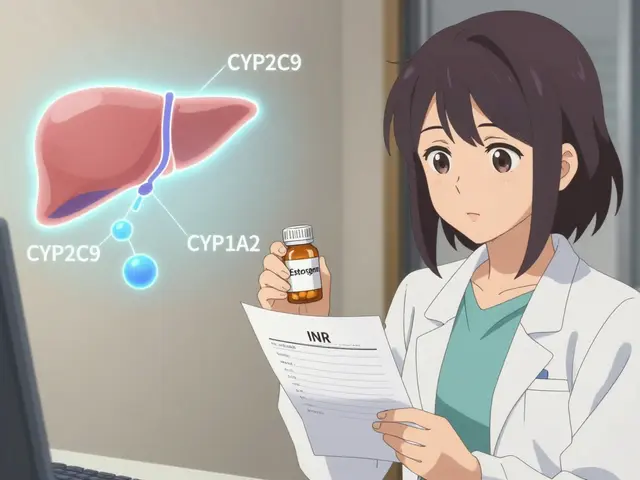

Complex Drugs Block Competition

Not all drugs are created equal. A simple tablet of metformin? Easy to copy. A complex inhaler, a long-acting injectable, or a topical gel with a specific release mechanism? Not so much.

For these advanced formulations, generic makers must prove they’re identical in every way-how the drug dissolves, how it’s absorbed, even how it behaves in the body over time. That’s called proving Q1, Q2, and Q3 equivalence. It requires expensive studies, specialized equipment, and deep regulatory knowledge. Only the biggest generic companies can afford it. That means even if 10 companies have approval to make the drug, only 2 or 3 actually sell it.

This is the complexity advantage. It’s not a patent. It’s a technical wall. And it keeps prices higher than they should be. The FDA estimates that drugs with complex delivery systems have 40% fewer generic competitors than simple pills.

Who Really Controls the Market?

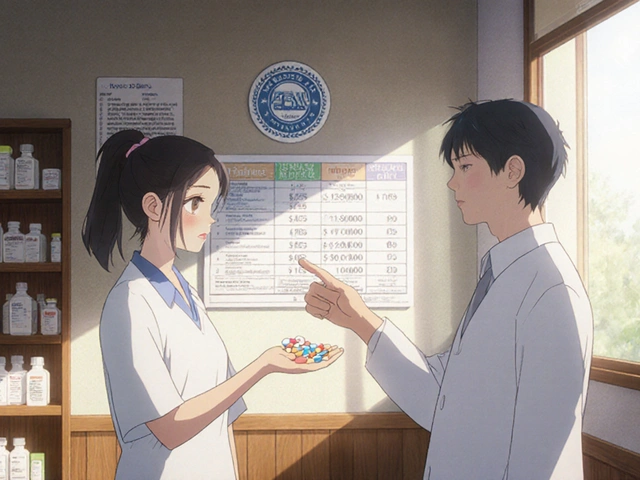

Most people think pharmacies and doctors decide what drugs get sold. But in the U.S., it’s Pharmacy Benefit Managers (PBMs) that control 90% of drug purchasing. These are middlemen hired by insurers to negotiate prices. They don’t care how many generics are out there-they care about the lowest net price after rebates.

That changes everything. A generic drug might be cheaper at the pharmacy counter, but if the PBM gets a bigger rebate from the brand, they’ll push the brand anyway. This is why you sometimes see brand-name drugs on your insurance plan’s preferred list-even when generics are available. The system rewards rebates over competition.

And then there are authorized generics-versions of the brand drug sold by the same company, but under a generic label. These are often launched during the first 180 days of generic exclusivity. They undercut the first generic, driving its price down. But here’s the catch: if the brand company owns the authorized generic, wholesale prices drop 8-12%. If someone else owns it? Brand prices jump 22% higher. It’s a game of chess, not checkers.

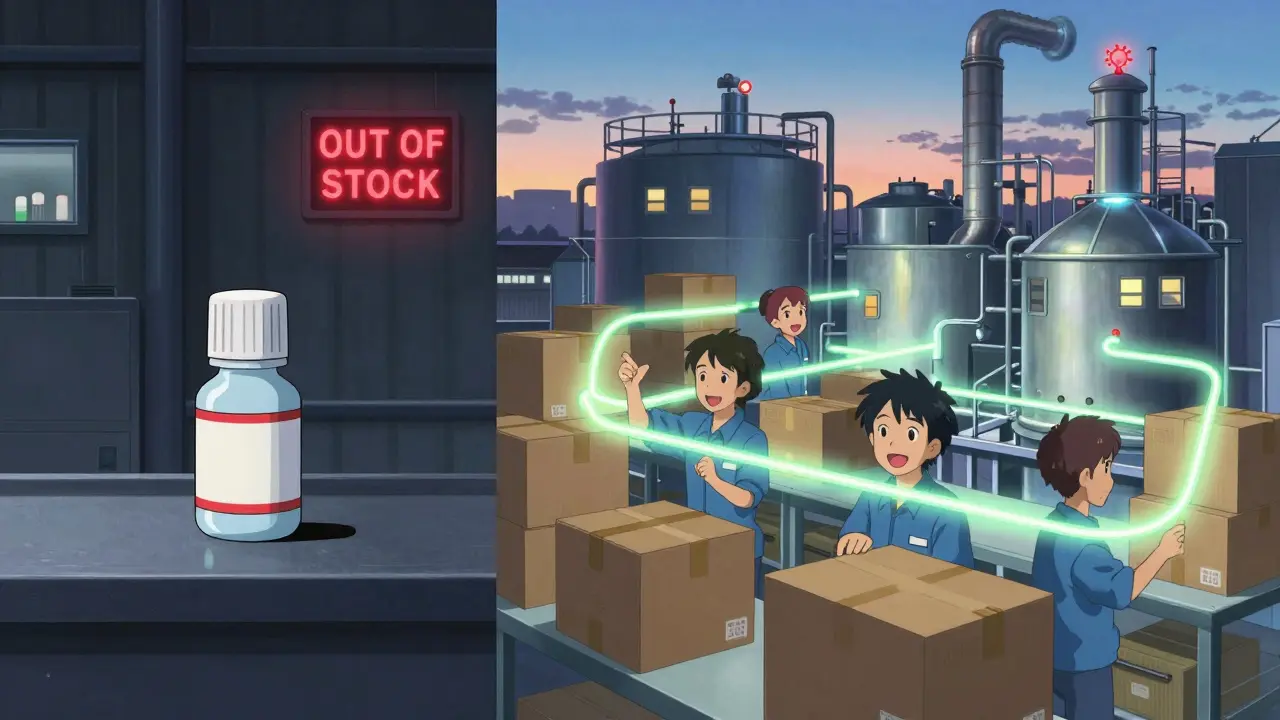

Supply Chain Stability Depends on Competition

Low prices aren’t the only thing at stake. When only one company makes a generic drug, the supply chain is fragile. If that company has a production issue, shuts down, or gets hit by a recall, shortages happen. Between 2018 and 2022, drugs with only one generic supplier had 67% more shortages than those with three or more manufacturers.

That’s why having multiple competitors isn’t just about cost-it’s about safety. Imagine needing insulin or seizure medication and finding out your usual generic isn’t available. The FDA has documented dozens of cases where patients had to switch treatments mid-course because of a single-source shortage. Multiple manufacturers mean backup. They mean resilience.

The New Threat: Medicare Price Negotiation

The Inflation Reduction Act of 2022 lets Medicare negotiate prices for some of the most expensive brand-name drugs. That sounds good-until you look at the ripple effect.

Generic makers are profit-driven. If the brand’s price is capped at $100, and the generic costs $80 to make, there’s no incentive to enter the market. Why spend millions on regulatory approval and manufacturing if the maximum price you can charge is $90? The result? Fewer generics. Slower competition. And eventually, higher prices for patients who don’t qualify for Medicare.

This is a new kind of market distortion. Instead of competition lowering prices, government price controls might be killing the pipeline that makes competition possible.

Why Some Markets Have Fewer Competitors

In China, eight quarters after a generic enters the market, the average number of competitors per drug is just 2.4. But that number hides the truth: 70% of drugs have only one or two generics. Only 30% have three or more. In the U.S., the average is higher-but still far below what the system promises.

Why? Because the first generic gets 180 days of exclusivity. During that time, it captures 80% of the market. Other companies wait. Why risk investing in a market where the first mover owns most of the customers? This creates a winner-takes-most dynamic. Even when the FDA approves ten generics, only one or two ever sell.

And patents? They’re still a weapon. Brand companies file dozens of them-not all valid, but enough to delay generics for years. Some even pay generic makers to stay out of the market. These “pay-for-delay” deals cost consumers billions.

What’s Next? Biosimilars and Digital Tools

The next wave of competition isn’t just about pills. It’s about biologics-complex drugs made from living cells. Think cancer treatments like Humira or insulin analogs. These aren’t easy to copy. The first biosimilars are starting to appear, but they cost 10-30% less, not 80-90% like small-molecule generics. That’s because they require massive clinical trials and specialized manufacturing.

And now, digital tools are changing how drugs are prescribed and tracked. Apps that flag generic substitutions, AI that predicts shortages, and blockchain systems for drug traceability are all emerging. These won’t replace competition-but they might make it smarter. Imagine knowing in real time which generic supplier has the most reliable stock. That could shift power away from PBMs and back to patients and providers.

Bottom Line: Competition Isn’t Automatic

More generic competitors don’t automatically mean lower prices. They don’t guarantee better access. They don’t even ensure supply stability. The real drivers are market structure, regulatory design, and corporate strategy. A system that rewards rebates over transparency. A regulatory process that favors big players. A payment model that lets brands raise prices when they feel safe.

For patients, the lesson is simple: don’t assume generics are cheap just because they exist. Ask your pharmacist: How many companies make this drug? Is there a shortage risk? Is there a cheaper alternative? For policymakers, the challenge is clearer: fix the system so that competition works the way it’s supposed to-by driving down prices, not just filling shelves with copies that never compete.

Comments

srishti Jain

Generic drugs are a scam. My cousin died because the cheap version didn’t work. No one talks about that.

Glendon Cone

Yeah but like… imagine if we could track which generic supplier actually has stock in real time? 🤔 AI + blockchain could fix so much of this mess. PBMs are just middlemen who got too comfy.

Sandeep Mishra

It’s wild how we treat medicine like a commodity when it’s literally life or death. We’ve built a system where profit > patient, and now we’re surprised when it breaks. Maybe we need to stop pretending markets can fix everything. Some things deserve to be public goods, not stock options.

Henry Ward

Oh please. You think this is about patients? Nah. It’s about CEOs on yachts laughing while grandma chooses between insulin and rent. And you’re all just debating the math like it’s a TED Talk. Wake up.

Joseph Corry

The entire structure is a beautifully engineered failure. Mutual forbearance among generics? That’s not market efficiency-that’s oligarchic collusion dressed in white lab coats. And don’t get me started on PBMs-they’re the invisible hand that’s been choking the throat of competition since the 90s. The FDA’s metrics are laughably outdated. We’re measuring equivalence in dissolution curves while the real game is in rebate arbitrage. This isn’t capitalism. It’s rent-seeking masquerading as innovation.

The ‘complexity advantage’? That’s just a legal loophole for Big Pharma to outsource R&D costs to the public while locking in monopolies through regulatory capture. Biosimilars are the next frontier, but they’ll be neutered by the same players who made small-molecule generics a joke. The Inflation Reduction Act? A PR stunt. Cap the price of Humira at $100? Great. Now no one will make the generic because the marginal cost is $95. Brilliant.

We don’t need more competition. We need a new paradigm. Decentralized manufacturing. Publicly funded generic production. Mandatory transparency in rebate structures. And maybe-just maybe-stop letting lawyers and accountants run the healthcare system.

Kunal Karakoti

It’s funny how we assume more choices = better outcomes. But in medicine, choice without trust is just confusion. If your heart meds come from a factory you’ve never heard of, you don’t feel safe-even if the science says it’s identical. That’s not irrational. It’s human. Maybe the real problem isn’t the market… it’s our fear of the unknown.

Aayush Khandelwal

The PBM cartel is the real villain here-opaque, unregulated, and utterly unaccountable. They’re not negotiating prices-they’re negotiating kickbacks. And the ‘authorized generics’? That’s not competition. That’s corporate sabotage with a FDA stamp. It’s like letting the fox design the henhouse and then calling it ‘market efficiency.’

And let’s not pretend the 180-day exclusivity window is about incentivizing innovation. It’s a backdoor monopoly granted to the first mover who didn’t even invent the damn drug. It’s a corporate welfare program disguised as patent law.

We need a public drug procurement agency. Not just for Medicare. For everyone. Cut out the middlemen. Pay fair prices. Reward scale, not secrecy. And for god’s sake, ban pay-for-delay deals. They’re not loopholes-they’re crimes.

Hayley Ash

Wow so many words to say ‘pharma is evil’ 🙄 Next you’ll tell me water is wet and gravity exists. Of course the system’s broken. But guess what? It’s always been broken. People just didn’t notice until their insulin bill hit $800. Congrats, you’re late to the party.

henry mateo

just read this and thought of my dad who takes blood pressure meds… he swears the generic he gets now ‘feels different’… i told him it’s the same chemical but he says ‘no, it’s not the same’… maybe he’s right? maybe the body knows things the lab reports don’t? just wondering…

Colin L

Let’s not forget the global angle. Most generic manufacturers are in India and China, right? But here’s the kicker-those countries have their own regulatory nightmares. Contamination scandals. Fake batches. Poor quality control. And yet, we import 80% of our active pharmaceutical ingredients from there. So when we complain about ‘lack of competition’ in the U.S., we’re actually complaining about a supply chain that’s held together by duct tape and wishful thinking. The FDA inspects maybe 2% of those plants. Two percent. That’s not oversight. That’s a prayer.

And don’t even get me started on the environmental cost. These factories dump waste into rivers. People downstream get cancer. We get cheap pills. Everyone wins? No. We just outsourced the horror.

So when you say ‘more competitors = better,’ you’re not thinking about the people who live near the factories. You’re thinking about your prescription being $5 cheaper. That’s not progress. That’s moral evasion.

And then there’s the labor. Workers in these plants-mostly women-get paid pennies. They’re not unionized. They’re not protected. They’re breathing in chemical fumes so you can save $12 on your antidepressants. Is that the kind of ‘competition’ you want?

Maybe the real question isn’t how to make generics cheaper. Maybe it’s how to make the whole system humane.

kelly tracy

Of course the system is rigged. It’s always been rigged. The only reason you think this is new is because you finally got hit with a $500 bill. Welcome to reality, sweetheart. Now go cry to your therapist.